Florida has recently adopted a positive change to how eligibility for Medicare Savings Programs (MSPs) is determined. The change is related to how the household size is determined for establishing the income limit for a MSP, and will result in more people being eligible for MSPs than before. Please read below for more information.

What is a Medicare Savings Program (MSP)?

A MSP helps pay Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) premiums. They may also pay Part A and Part B deductibles, coinsurance, and copayments.

What are the different MSPs in Florida?

How is MSP Eligibility Calculated?

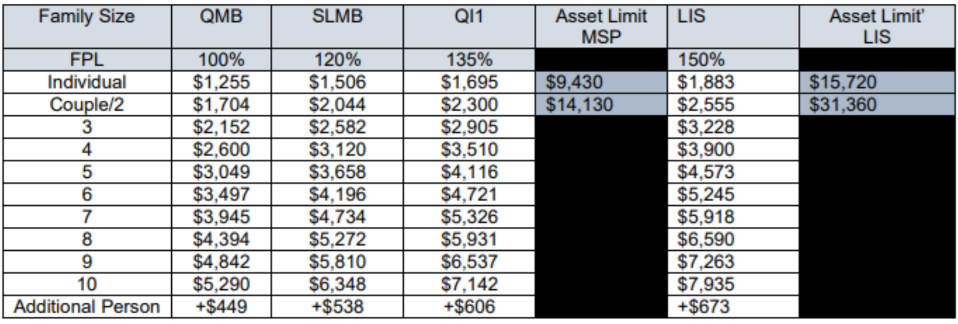

To determine MSP eligibility, the Department of Children & Families (DCF) evaluates the countable income (in addition to technical requirements and applicable asset limits) of the MSP applicant and compares that countable income to the applicable limit. The applicant’s family (or household) size determines what applicable income limit will be used.

Below is a chart showing the income limits for each family size. As the chart demonstrates, the income limit for an applicant with a family size of four (4) is $2600 for QMB, $3,120 for SLMB, and $3,510 for QI-1.

Note: A $20 general exclusion applies in each of these programs. Individuals can have up to $20 more in unearned income and pass the income test. Other income disregards including for earned income and work expenses may apply depending on individual circumstances.

➢ Old Rule

DCF determined the number of individuals in the family (or household) size based only on whose income was being counted for eligibility purposes. Thus, the household size was limited to those whose income was deemed to be the applicant’s (spouse to spouse or parent to child). This made the possible household size small and, therefore, reduced the applicable income limits, making it harder to qualify.

➢ New Rule

DCF now uses the total family (or household) size to determine the income limit that will apply to the applicant.

❖ “Family Size” Under New Rule

Family size is now defined as: the applicant, the applicant’s spouse (if living with the applicant), and any persons related by blood, marriage, or adoption, who are living with the applicant and spouse and who are dependent on the applicant or spouse for at least one half of their financial support.

As was the case under the old rule, the income and assets of the dependent household members are not counted against the applicant.

Example

Assume a 67-year-old applicant is enrolled in Medicare and receives $1500 per month in Social Security Retirement benefits. The applicant lives with her 59-year-old wife, who has a part-time job earning $1000 per month, her 21-year-old child earning $500 per month, and her 1-year-old grandchild.

Under the old rule, only the applicant and the wife’s income would be considered in determining the applicant’s MSP eligibility, and the applicable income limit (see chart above) would have been $1,704 for QMB, $2,044 for SLMB, and $2,300 for QI-1.

Under the new rule, the household size is four (4) people because everyone is related by blood, and the adult child and grandchild rely on the applicant and her spouse for at least one-half of their financial support. Therefore, the income limit under the new rule is $2,600 for QMB, $3,120 for SLMB, and $3,510 for QI-1 (see chart above).

Importantly, only the applicant’s and spouse’s incomes will be used to determine the countable income for the household.

Thus, the increase in the household size makes it more likely that the applicant will qualify for an MSP.

You can apply for an MSP through DCF’s MyACCESS system. DCF does offer a separate application for MSP coverage only, but we do not recommend use of this application because DCF has not revised it to include information about all household members in accordance with the new rule.

If you have questions about this document, please contact Lynn Hearn at hearn@floridahealthjustice.org.